2020 has been a tough year all around, but especially so when it comes to economic uncertainty and financial anxiety. Millions of men and women around the world are experiencing hardship related to these two factors.

2020 has been a tough year all around, but especially so when it comes to economic uncertainty and financial anxiety. Millions of men and women around the world are experiencing hardship related to these two factors.

With no end in sight, many are opting to take matters into their own hands. They’re taking a hard look at their personal finances to determine whether or not it’s possible to improve their situation themselves.

For most individuals undergoing financial difficulties in 2020, debt management hangs front and center. Between student loans, possible divorce, car loans, mortgage payments, and old fashioned credit card debt, finding ways to make the monthly payments without going broke is critical.

Finding the best path towards financial freedom is what companies like Plymouth Associates do best. It’s no surprise PlymouthAssociates.com saw an increase in website traffic during 2020. Whether it’s debt relief, building a budget, or information about other matters related to money and finance, services like Plymouth Associates are there to help consumers make sense of their finances.

It starts with debt consolidation. Consumers tend to save hundreds on interest by opting to have credit card debt converted into a single loan payment. To better determine whether or not that’s the right choice to make, Plymouth Associates provides a comparison calculator on their website. From there, consumers can decide if they wish to apply for a consolidation loan or continue to manage their debt piece-by-piece.

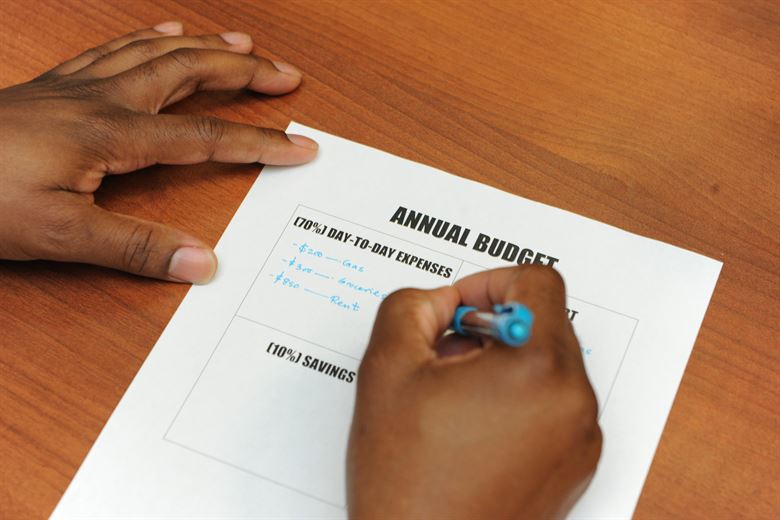

However, debt management is only one part of achieving greater financial security. Better money management is also key, as well as budgeting and living within one’s means. It’s almost impossible to find financial freedom if you’re spending every dollar you make every month on bills and expenses.

To this end, services like Plymouth Associates also spend time publishing useful blog posts covering a wide range of financial topics. These informative reads help consumers make sense of commonly misunderstood concepts and hurdles touching on car ownership, homeownership, retirement, and more.

Individuals can also learn how to be better with their money month-to-month. For instance, the best ways to creates a budget and stick to it, even when times are tough. Effective ways to spend less on essentials is also useful.

But let’s be honest: most people experiencing financial difficulties would be better off if they were paid more. Sure, everyone wants to earn more money, but it’s a matter of not being paid a fair wage for millions of Americans. It’s currently impossible for minimum wage earners to afford rent in any state. That’s because wages have not caught up with inflation, meaning a dollar doesn’t go as far as it did even five years ago.

Until the day comes when hardworking men and women are paid a fair wage, the rate of people struggling with financial insecurity will continue to climb. While financial advice can make a big difference in their lives, it only goes so far. The same is true for debt management solutions. Though instrumental, they’re ultimately ineffective at solving the long-term problems associated with financial hardship.